Comprehensive Real-Time Japanese Stock Market Monitoring System

Executive Summary

We’ve developed a sophisticated WebSocket-based system that provides real-time monitoring of the entire Japanese stock market ecosystem. This system offers complete coverage of all ~4,000 listed stocks on the Tokyo Stock Exchange, along with Nikkei 225 futures and options data – a comprehensive scope rarely found in publicly available platforms. While the interface displays in Japanese, the underlying architecture and this documentation are designed for international users interested in accessing one of the world’s most undervalued equity markets.

Why Japanese Equities Matter Now

As someone who exclusively invests in Japanese stocks, I believe the current market presents exceptional opportunities. While many Japanese investors chase overvalued U.S. equities, the domestic market offers compelling valuations that international investors are beginning to recognize. Warren Buffett’s significant investments in Japanese trading houses have validated what value investors have long suspected: Japan offers quality companies at reasonable prices, unlike the stretched valuations common in U.S. markets.

System Capabilities

Comprehensive Market Coverage

Our system is unique in providing real-time access to:

- All ~4,000 stocks listed on the Tokyo Stock Exchange (TSE)

- Nikkei 225 Index futures (full-size, mini, and micro contracts)

- Complete Nikkei 225 options chain with real-time Greeks and order flow

- Major Japanese indices (TOPIX, JPX-Nikkei 400)

- Coverage across all three market segments: Prime, Standard, and Growth (following the 2022 TSE restructuring)

- Sector-specific indices and ETFs

- Real-time order book depth for all securities

Key Features

- Language Note: While the system interface displays in Japanese (reflecting its primary data sources), the underlying data is universally interpretable – numbers are numbers in any language

- Real-time price updates via WebSocket for minimal latency

- Advanced filtering by sector, market cap, and performance metrics

- Comprehensive search functionality by ticker symbol or company name

- Full derivatives chain display with implied volatility calculations

- Mobile-responsive design for monitoring on any device

- Visual price change indicators and heat mapping

Technical Architecture

Data Flow System

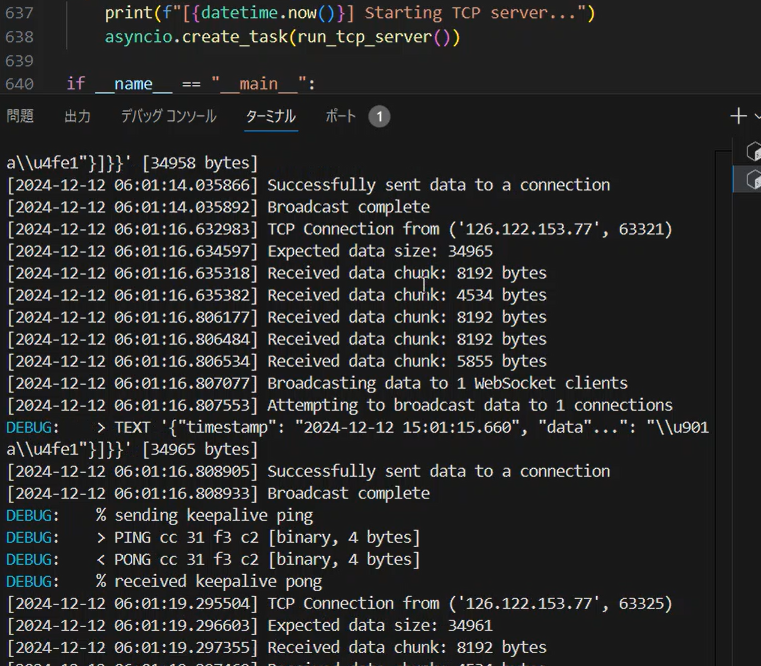

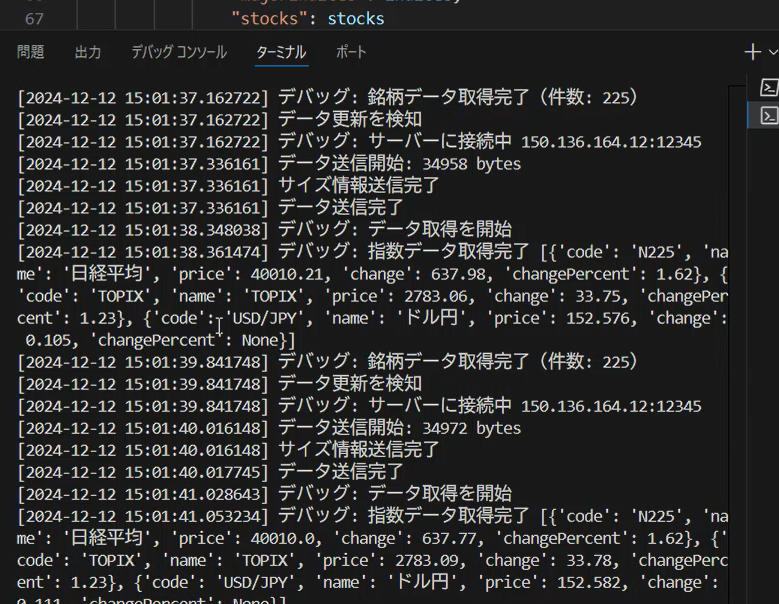

The system employs a dual-program architecture built in Python:

- Data Acquisition Layer: Connects to multiple Japanese market data sources, normalizing and validating incoming streams

- Distribution Layer: FastAPI-based WebSocket server that efficiently broadcasts updates to connected clients

WebSocket Implementation

Our WebSocket approach offers several advantages for market data distribution:

- Sub-second latency for price updates

- Efficient bandwidth usage through delta updates

- Automatic reconnection handling for network instability

- Support for hundreds of concurrent connections

- Hash-based deduplication to prevent redundant data transmission

Operational Considerations

Availability

- Primary Operating Hours: The system runs during Tokyo Stock Exchange trading hours (9:00-15:00 JST, with a lunch break from 11:30-12:30)

- Weekend/Holiday Status: The system may be offline during Japanese market holidays or during maintenance periods

- Live Demo: https://vibelsd.com/japanese-stock/ (availability subject to market hours)

Data Integrity

We maintain data quality through:

- Multiple source validation

- Real-time anomaly detection

- Historical tick data storage for backtesting

- Redundant data paths for critical indices

Global Market Integration

While currently focused on Japanese markets, the architecture supports expansion to other Asian and global markets:

sequenceDiagram

participant Sources as Data Sources<br/>(Exchange/API/Tools)

participant Collector as Data Collector

participant Server as WebSocket Server

participant Clients as Clients

rect rgb(240, 240, 240)

Note over Sources: Multi-source Support

Sources->>Collector: Market Data

end

activate Collector

Note over Collector: Data Standardization<br/>Deduplication

Collector->>Server: TCP/WebSocket

deactivate Collector

activate Server

rect rgb(240, 240, 240)

Note over Server: Multi-client Distribution

Server->>Clients: Real-time Data

Clients-->>Server: Bidirectional Communication

end

deactivate ServerThe modular design allows for integration of:

- Other Asian markets (Singapore, Hong Kong, Korea)

- Commodity futures from global exchanges

- Currency pairs relevant to yen-based trading

- Cross-market arbitrage opportunities

Advanced Features

Options Analytics

The system provides sophisticated options analysis tools:

- Real-time implied volatility surfaces

- Greeks calculation for all strike prices

- Option flow analysis showing large block trades

- Put/call ratio tracking

- Volatility smile visualization

Market Microstructure Data

- Level 2 order book depth

- Time and sales with aggressor indication

- Block trade identification

- Dark pool activity indicators (where available)

Investment Philosophy

Having developed this system as a dedicated Japanese equity investor, I’ve designed it to surface the opportunities that make this market compelling. While global investors pile into expensive U.S. technology stocks trading at 30-50x earnings, many Japanese companies trade below book value with strong balance sheets and growing dividends. This system helps identify these opportunities in real-time.

Technical Implementation Details

Data Storage Architecture

flowchart LR

subgraph Data Sources

Exchange[(Exchange API)]

Tools[(Trading Tools)]

Feed[(Market Feed)]

end

subgraph Backend Processing

Collector[Data Collector]

Server[WebSocket Server]

Cache[(Cache System)]

end

subgraph Frontend Applications

Web[Web Browser]

Mobile[Mobile App]

Trading[Trading Tools]

end

Exchange -->|Market Data| Collector

Tools -->|Trading Data| Collector

Feed -->|Information Feed| Collector

Collector -->|Standardization| Server

Server <-->|Cache| Cache

Server -->|Real-time Data| Web

Server -->|Real-time Data| Mobile

Server -->|Real-time Data| Trading

style Exchange fill:#f9f,stroke:#333,stroke-width:2px

style Server fill:#bbf,stroke:#333,stroke-width:2px

style Cache fill:#bfb,stroke:#333,stroke-width:2px

style Web fill:#fbf,stroke:#333,stroke-width:2pxOur hybrid storage approach combines:

- In-memory caching for ultra-low latency

- Time-series database for historical analysis

- Redundant Excel/CSV exports for backup

- MySQL/MariaDB for structured queries

GitHub Repository

The core components are available at: https://github.com/superdoccimo/ayumi

Blog Documentation

Detailed implementation notes:

Future Development Roadmap

We’re actively developing:

- English interface options for international users

- AI-powered market anomaly detection

- Automated arbitrage opportunity alerts

- Integration with international brokers’ APIs

- Real-time sentiment analysis from Japanese financial media

- Machine learning-based volatility forecasting

Why This System Matters

The Japanese equity market remains one of the most inefficient developed markets, offering opportunities for informed investors. With a aging population driving corporate governance reforms, record share buybacks, and the end of decades of deflation, Japan presents a unique investment landscape. This system provides the tools to navigate it effectively.

Unlike generic financial platforms that treat Japan as an afterthought, this system is built specifically for serious investors who recognize the value in the world’s third-largest equity market. Whether you’re interested in the global industrial champions of the Nikkei 225 or seeking hidden gems among small-cap value stocks, our comprehensive coverage ensures you won’t miss opportunities.

Conclusion

This system represents more than just another market data platform – it’s a window into one of the most undervalued developed markets in the world. While others chase momentum in overvalued U.S. tech stocks, sophisticated investors can use this tool to find genuine value in Japan. The combination of comprehensive coverage (all ~4,000 listed stocks plus complete derivatives chains), real-time WebSocket delivery, and focus on the Japanese market makes this a unique resource for serious investors.

Remember: while fashionable investors crowd into the same expensive U.S. names, the real opportunities often lie where others aren’t looking. Japan, with its improving corporate governance, reasonable valuations, and weakened yen providing a natural hedge, represents such an opportunity. This system is your gateway to accessing it.

Note: System availability depends on Japanese market hours and maintenance schedules. The interface currently displays in Japanese, reflecting the primary data sources, but the numerical data is universally interpretable. For questions or access requests, please refer to the GitHub repository.